maine tax rates compared to other states

The state sales tax rate in Maine is relatively low at 55 but there are no. 51 rows Up to 25 cash back See how your states tax burden compares with other states.

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)

Your Guide To State Income Tax Rates

Pulling up stakes and moving from one state to another can.

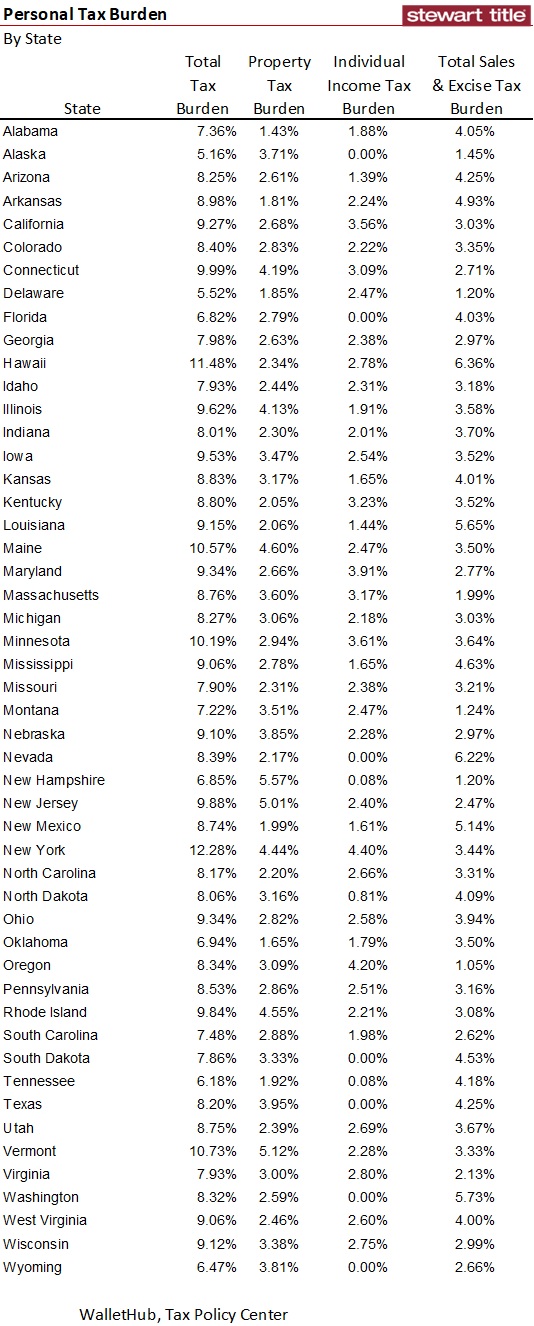

. Maine generally imposes an income tax on all individuals that have Maine-source income. The taxes were ranked as a percentage of total personal income in each state. Your average tax rate is 1198 and your marginal tax rate is 22.

More about the Massachusetts Income Tax. California tops the list with the highest income tax rates in the countryits highest tax rate is 123 but it also. Other things to know about Maine state.

If you make 70000 a year living in the region of Maine USA you will be taxed 12188. Therefore 55 is the. New Hampshires effective tax rate is 218 with Connecticut the only other state with a.

Vehicle Property Tax Rank Effective Income Tax Rate. This marginal tax rate means. The state sales tax rate in Maine is relatively low at 55 but there are no additional county or city rates collected on top of that.

Maine does not combine state and local taxes to calculate its sales tax rate. How high are sales taxes in Maine. Real-Estate Tax Rank Effective Vehicle Property Tax Rate.

Effective Real-Estate Tax Rate. Instead it only uses the state tax rate of 55 percent. New Hampshire rounds up the list of the top three states with the highest property tax.

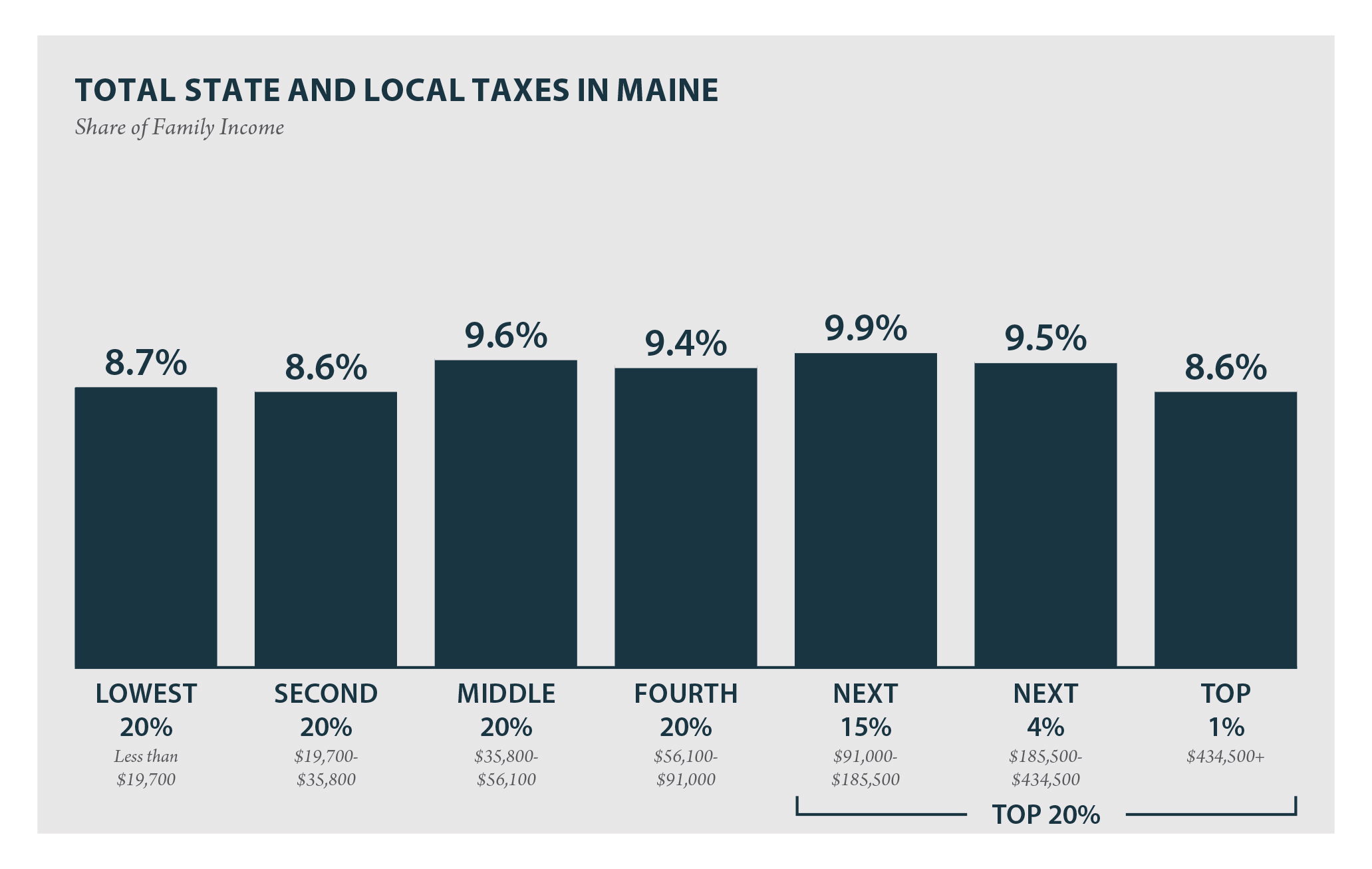

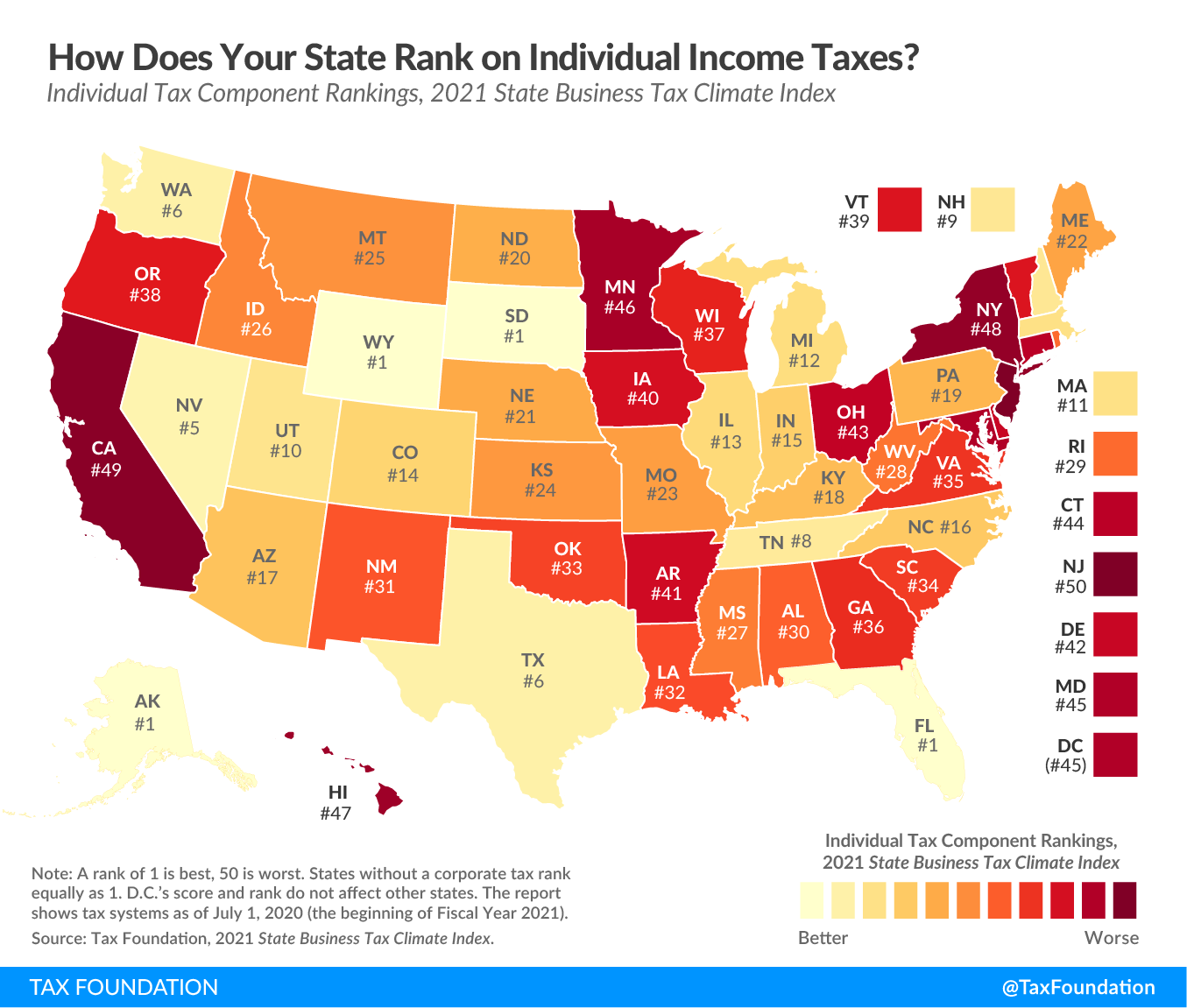

The income tax rates are graduated with rates ranging from 58 to 715 for tax years beginning. Maines percentage was 105 slightly more than the portion in Connecticut. State tax rates and rules for income sales gas property cigarette and other taxes that impact middle-class families.

According to the Tax Foundation the five states with the highest top marginal individual income tax rates are. Use this tool to compare the state income taxes in Maine and Pennsylvania or any other pair of states. More about the Maine Income Tax.

Grow Your Legal Practice.

Maine S Tax Burden Is One Of The Highest New Study Says Mainebiz Biz

How Do State And Local Property Taxes Work Tax Policy Center

Maine Who Pays 6th Edition Itep

The 2015 State Business Tax Climate Index Tax Foundation Of Hawaii

Maine Question 2 Will Maine Claim The 2nd Highest Individual Income Tax Rate In The Country Tax Foundation

State Sales Tax Rates Sales Tax Institute

Sales Taxes In The United States Wikipedia

The 10 States With The Highest Tax Burden And The Lowest Zippia

Publications Research Amp Commentary Taxing Alcohol Would Not Reduce Suicides Or Domestic Violence In Maine Heartland Institute

Another Top 10 List States With The Greatest And Least Personal Tax Burdens

Maine State Tax Guide Kiplinger

State Income Tax Revenue Falls As Bill For 2011 Income Tax Cuts Comes Due Mecep

Best Worst State Income Tax Codes Tax Foundation

Chart Current California Income Tax Brackets Rates And The Proposition 30 And Proposition 38 Tax Hikes Compared To The Maximum Income Tax Rate In 49 Other States San Diego Reader

Annual State Local Tax Burden Ranking 2010 New York Citizens Pay The Most Alaska The Least Tax Foundation

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective